The REG (Regulations) CPA exam section tests candidates’ understanding of taxation at a federal level, law and legal matters in a business context, as well as the ethical and legal standards an entity and professional should be responsible for.

In other words, the REG CPA Exam covers business law and federal taxation topics. This section can be particularly difficult for people who don’t have any taxation experience or candidates who hate memorizing boring tax facts and data.

Let’s take a look at the REG structure, topics covered, and how you can pass the REG exam on your first try.

- 1.Becker CPA Review Course: Rated the #1 Best CPA Review Course of 2025

- 2.Surgent CPA Prep Course: Best Technology

- 3.Gleim CPA Review Course: Largest Question Bank

What’s on the REG CPA Exam Section?

How Long is the REG CPA Exam?

REG is a 4-hour exam.

REG Topic Areas & Concepts Tested

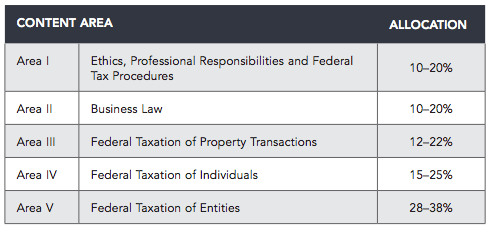

Federal Tax Procedures and Professional Ethics & Responsibilities: 10% – 20% – these topics cover professional conduct, independence, and liability. Independence affects a CPAs ability to be objective.

Business Law: 10% – 20% – covers contracts, transactions or debt relationships, and commercial regulations. This topic can cover things like UCC or Uniform Commercial Code and various business structures.

Property Transaction Taxation: 12% – 22% – The differences between the taxations of a business and the taxations of an individual will be tested with subjects like an alternative minimum tax (AMT) and the importance of gross income inclusion, along with the taxations of transactions involving property and assets.

Federal Individual Taxation: 15% – 25% – covers all individual income tax topics like deductions, exemptions, gains, losses, carryforwards, carrybacks, and everything else related to the 1040 form and its schedules.

Entity Taxation: 28% – 38% – covers legal entities and the ways they are taxed like trusts, tax vehicles, corporations, partnerships, and sole proprietorships. This may draw from information from the IRC local state boards, and other regulatory agencies.

REG CPA Exam Format and Structure

The REG exam consists of five different testlets. The first two testlets contain 38 multiple-choice questions each. After the first two MCQ testlets have been submitted, you will be allowed to take an optional 15-minute break. This break will not count against your total 4 hour testing time.

After you come back from break, you will have three more testlets of tasked based simulations. The first TBS testlet will consist of 2 simulations. The second and third testlet will have 3 simulations each.

REG Exam Section Structure

| REG Exam Section | 2016 CPA Exam | 2017 CPA Exam |

|---|---|---|

| Multiple-Choice Questions | 72 | 76 |

| Task-Based Simulations | 6 | 8 |

| Written Communication | 0 | 0 |

REG Exam Section Format

| Testlets | Question Sets |

|---|---|

| Testlet #1 | 38 Multiple-Choice Questions |

| Testlet #2 | 38 Multiple-Choice Questions |

| Testlet #3 | 2 Task-Based Simulations |

| Testlet #4 | 3 Task-Based Simulations |

| Testlet #5 | 3 Task-Based Simulations |

Get Discounts On CPA Review Courses!

Enjoy $1,331 Off Becker CPA Pro+

Take $1,330 Off Becker CPA Pro

Enjoy $1,050 Off Gleim CPA Premium Pro Course

Get $1,000 Off Becker CPA Concierge

Take $629 Off Surgent CPA Ultimate Pass

Becker CPA: Interest-Free Payment Plan – Deal

Becker Deal: Save on CPA Single Part Courses

Get CPA Evolution Ready Content on All Becker CPA Courses – Deal

Becker CPA Advantage Package Now $2,499 – Promo

Enjoy a 14-day Free Trial on Becker CPA Courses

Multiple-Choice Questions

As of 2017, there will be 76 multiple-choice questions on the REG. These questions are split into two 38-question testlets. The first 38 questions will be moderate difficulty MCQs. If you do well on these, the next 38 questions will move up to advanced difficulty questions. The opposite is true if you do poorly on the first section.

It sounds weird, but you actually want the harder questions because they are worth more. Difficult questions are weighted differently than easy questions. Thus, one difficult question could be worth several easy questions.

Task-Based Simulations

There are 8 task-based simulations in the REG section. These are split into three different testlets and are formatted in a few different ways: matching, fill-in-the-blank, and research.

Out of the 8 simulations, 7 are operations and 1 is pretest. There is no difference in difficulty between pretest and operational questions, the only difference is that operations simulations are scored and added to your grade while the pretest is not.

Testlet and Simulation Time Length

As with all the CPA exam sections, there is no time limit or requirement for each testlet. You have four hours to complete the entire exam, which means you need to budget your time wisely.

I recommend that you leave about 2 – 2.5 hours for the simulations. This means you have about 1.5 – 2 hours to finish all of the multiple-choice questions. In other words, you have about 110 seconds to answer each MCQ.

How is the REG CPA Exam Weighted and Graded?

The AICPA weights the MCQs and the TBSs the same. In other words, each count towards half of your grade. This is a change from past years’ exams where the MCQs were significantly more valuable than the simulations. Now you have to pay an equal amount of attention to both parts of the exam.

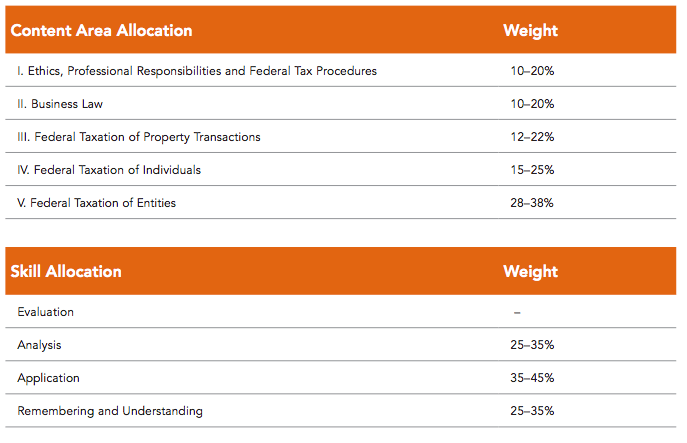

Here’s a breakdown of the REG CPA Exam content area allocation and the weights for each. This table shows how much of the exam will be made up of each of these topics. Also, the below table shows the skill level allocation that the new CPA exam blueprint uses to test your knowledge of each topic.

MCQ and Simulation Grading Percentage and Distribution

What Percentage of the Grade is Given to MCQ and Simulations? Half of your score is based on the 76 multiple-choice questions and the other half is based on the 8 task-based simulations. Of course, only the operations questions count towards the grade.

| Exam Section | 2016 CPA Exam | 2017 CPA Exam |

|---|---|---|

| AUD | 60% MCQ 40% TBS |

50% MCQ 50% TBS |

| BEC | 85% MCQ 15% WC |

50% MCQ 35% TBS 15% WC |

| FAR | 60% MCQ 40% TBS |

50% MCQ 50% TBS |

| REG | 60% MCQ 40% TBS |

50% MCQ 50% TBS |

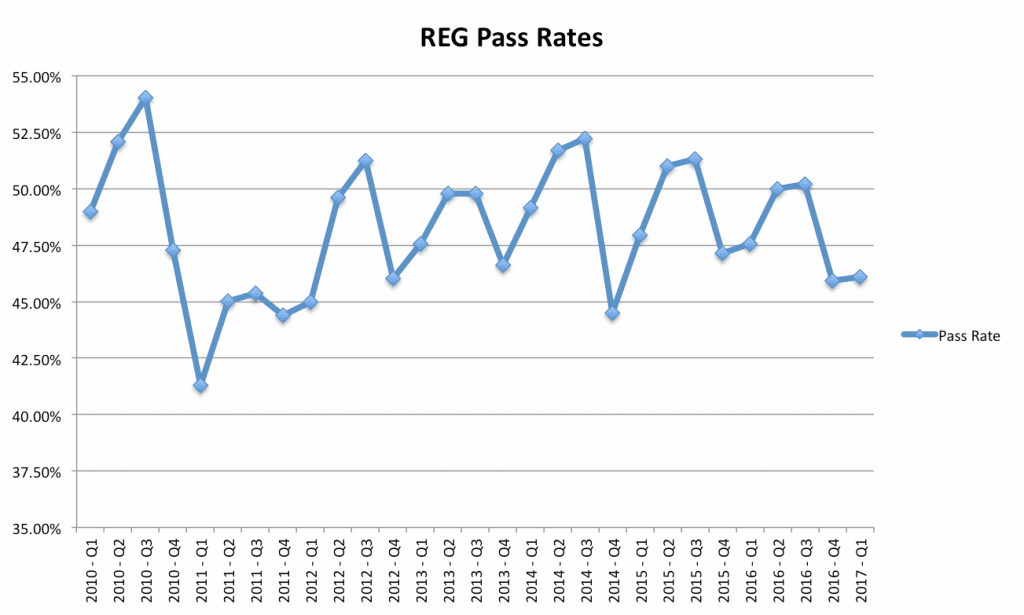

REG Exam Pass Rates

REG pass rates have been pretty stable since 2010. This is uncommon since most of the other CPA exam sections have seen a lot of fluctuation over the past few years since IFRS and the new CPA exam blueprint has been implemented.

This trend might be explained because FAR hasn’t changed that much over the years. The content is always changing with the tax code, so candidates are used to changing exam. The increased focus on simulations in 2017 might negatively affect the pass rates in the future, however. Only time will tell. This info is published by the AICPA.

REG CPA Exam Study Tips

Practice Your Memorization: REG will test your memorization skills. That’s pretty much all this exam is. You need to memorize tons of tax facts and figures that don’t make sense outside of the tax code. Follow your review course and develop mnemonics of your own to help memorize these concepts. Always keep going over the facts you need to know like deduction, exemption, and other amounts.

Take Notes: One of the best memorization techniques you can do is take notes and write things down. The more you write, the more you will remember. Make your own flashcards on these topics. You will remember them a ton better.

Break Up Tax Studying: The tax code is so boring. You can’t sit there for hours simply reading this stuff and memorizing it. Break up your study time between tax and law or tax and application. This will help you focus better and not fall asleep during the boring tax stuff.

Practice MCQs to Death: Keep working through your MCQs in your CPA review course. This is the best practice you can get. Do as many as possible.

Should I Take REG First?

This is a good question. I would recommend REG as the first exam for people who have a lot of experience with federal taxation. For instance, if you work as a tax accountant, this exam should be fairly straightforward for you. You have a lot of the tough memorization already done.

If taxes are a difficult topic for you, on the other hand, I wouldn’t recommend this as a first section. Here’s which exam you should take first.

Should I Take REG Last?

I think Regulation is a great last exam for people who are sufficient in taxation and law. That is, people who are not great, but also not horrible either. I don’t think that it is a good idea to save your most difficult exam last. That doesn’t make much sense especially if you are running up against the 18-month window.

Also, if tax and law come easy to you, this might be a better first exam than a last one. There’s no reason to save the easiest exam for last. Get it out of the way and done with. Here’s the order I would suggest.

Who is the REG CPA Exam Easiest For?

People who recently had tax experience or work as a tax accountant should have a pretty easy time with this exam. While a bunch of different topics are tested, tax-related questions make up 60% of the REG exam. Also, some people just have an easier time understanding learning laws than others. There really isn’t that much in terms of complicated business law topics on this exam, but if you did well in your BLAW classes in college, you will probably do well on this as well.

Also, people who are really good at memorizing facts will do well on REG. Most of the tax questions require you to memorize tables and numbers. How much is a standard deduction? How many years can losses be carried back? Things like that. Prepare to memorize!

Who is the REG CPA Exam Hardest For?

Let’s face it. Some people suck and taxes and law. It’s not for everyone. We need auditors too. 🙂 People who don’t understand tax extensions, tax years for entities and individuals, how to calculate gross figures, and how to determine correct filing statuses will have a tough time with this exam.

There’s a lot to memorize on this exam, so candidates who don’t take good notes and memorize lists will not do well. The key to REG is rote memorization.

Other CPA Exam Sections

Do You have the Right CPA Review Course?

Have you started studying yet or did you fail REG once? Either way, you’ll need a review course that actually works for you and matches your learning style. I compared all of the top courses side-by-side, so you can see which one is right for you. Check it out.