It can be painful to see a big chunk of your company’s profits being eaten up by taxes. Although most small business owners realize that income tax is a necessary evil, they would love to find small business tax deductions and other ways to cut down their tax bill.

Fortunately, this is perfectly legal and there are tons of ways to effectively do this!

Ultimately, you need to work on maximizing your tax deductions regardless of where you are in the development or operation of your business. Remember, these are the sums that you are legally allowed to reduce from your taxable income; therefore, making the best use of the deductions available to you will free up your business funds and profits for long-term success.

Higher deductions = Lower taxes

So what are the expenses that can be deducted from your income?

The Internal Revenue Service (IRS), which is the government body responsible for collecting taxes, says that the expense must be both “ordinary and necessary.”

In simple language, ordinary and necessary means that the expense must be directly related to your business. Consequently, employee pay can be deducted from your income. On the other hand, personal expenses aren’t usually an allowable expense.

Keep reading to see a deep dive into the subject of small business tax deductions. Which are the tax write-offs that are allowed and which aren’t? We’ll also look at a few lesser-known tax deductions and some expenses that you wouldn’t normally expect to find on a tax return.

Ultimately, you need to work on maximizing your tax deductions regardless of where you are in the development or operation of your business. Remember, these are the sums that you are legally allowed to reduce from your taxable income.

Top 10 Schedule C deductions you should be aware of

Here’s a brief description of some small business tax deductions that every entrepreneur should know about. All of these deductions can be applied to your Schedule C form, whether you’re self-employed as a freelancer or you’re running a small business.

1. Car expenses

Do you use your car for work? If you do, you’re allowed to deduct a specific amount when you compute your taxable profit. There are two methods to claim this deduction:

- Standard mileage rate: You’re allowed 57.5 cents per mile for the period beginning on January 1, 2020. In 2019, the rate was slightly higher at 58 cents. This rate is applicable to cars, vans, pickups, and panel trucks.

- Actual expense method: This is a little more complicated. You need to keep track of all your vehicle-related expenses. How much did you spend on gas, oil, tires, etc.?

Additionally, there are a few points that you should keep in mind about this deduction:

- Both methods require you to keep a record of your business trips. What was the starting point and where did you go? What was the purpose of the trip? Remember— you can’t deduct this if the trip wasn’t for business purposes.

- The distance traveled to and from your place of work isn’t allowed as a deduction. Instead, focus on the expenses incurred as a result of any distance you cover.

2. Depreciation

When you buy assets for your company like business equipment or furniture, you can’t deduct the entire amount from your income in the year of purchase. Instead, you’re required to depreciate these assets over several years. That’s because you will be using them for a period that is greater than a year.

Depreciation is essentially an annual allowance towards the wear and tear of your assets.

On which assets can you claim depreciation on your tax return?

The conditions that need to be met are:

- You must own the asset.

- It must be used in your business.

- It should last for a period that is greater than a year.

How much depreciation can a small business charge?

This is determined by the rules framed by the IRS. For example, Section 179 of the United States Internal Revenue Code allows a business to deduct the cost of some types of business property as an expense instead of requiring the sum to be capitalized and depreciated. The deduction limit for 2025 is $1,040,000.

Another useful deduction for small businesses is bonus depreciation. The Tax Cuts and Jobs Act of 2017 doubled bonus depreciation on specific types of property to 100% from the earlier rate of 50%.

When you buy assets for your company like business equipment or furniture, you can’t deduct the entire amount from your income in the year of purchase. Instead, you’re required to depreciate these assets over several years.

3. Interest expense on loans

Have you taken a small business loan? Do you use a business credit card on which you roll over your monthly statement balance? If your answer to either of these questions is yes, then you can deduct the interest that you pay from your taxable income.

However, you need to be careful when claiming this deduction in your tax return. Interest on a bank loan or a line of credit from a financial institution would usually be deductible. But if you’ve borrowed money from your wife or a friend, the IRS is likely to look at the transaction more carefully.

For interest to be allowed as a deduction, there must be a legal obligation to repay the debt— which means no personal loans from friends or family apply. Additionally, if you’ve borrowed money to buy something for personal use, the interest that you pay on the loan will not be allowed as a deduction.

Interest on a bank loan or a line of credit from a financial institution would usually be deductible. But if you’ve borrowed money from your wife or a friend, the IRS is likely to look at the transaction more carefully.

4. Rent Expense

Do you pay rent for your office or factory? There are several real estate related expenses that are allowed and this is one of them. However, the rent that you pay for your home isn’t permitted as a deduction.

What if you work from a home office?

In this situation, the IRS rules regarding Business Use of Your Home will apply. You could be allowed to deduct a part of your rent or mortgage interest as a home office deduction, in addition to insurance and certain other home-related expenses, from your business income.

5. Travel expenses

What if you travel for a business-related purpose? The expenses you incur could be tax-deductible. That being said, it’s necessary to meet certain conditions in order to qualify for a business travel deduction:.

First, the travel must involve being away from your “tax home.” What’s that? According to the IRS, it’s your regular place of business. Don’t confuse it with your family home— your tax home is the city or general area where you conduct your work.

Second, only certain expenses apply. You could be allowed to deduct the following:

- Transportation costs by airplane, train, bus, or car

- Taxi or bus fares

- Lodging and meals (only if your business trip involves an overnight stay)

There are a few more things worth mentioning about this particular tax break. Despite offering deductions for taxi fare, there’s no specific mention of ridesharing through apps like Uber or Lyft. Additionally, you’re not allowed to deduct meals or travel if they qualify as “lavish or extravagant,” with the exception of first-class plane travel.

What if you travel for a business-related purpose? The expenses you incur could be tax deductible. That being said, it’s necessary to meet certain conditions in order to qualify for a business travel deduction.

6. Insurance Expense

When you’re running a company, it could be necessary to buy several types of business insurance. These could include:

- Property insurance

- General liability insurance

- Business vehicle insurance

- Workers’ compensation insurance

- Professional liability insurance

As a general rule, you’re permitted to deduct the cost of insurance as a business expense.

7. Legal and professional fees

The amount that you pay your accountant or your attorney is a tax-deductible expense. Of course, the payment should be for business-related work. This means that any sum paid for filing personal taxes is not allowed, and neither are any amounts paid for legal matters that don’t pertain to your company.

8. Wages and salary expenses

As a boss, the payments that you make to your employees are tax-deductible. So are sums that you spend on employee benefit programs. For example, if you provide your workers with money in the form of education assistance, you can claim a write-off.

As usual, there are specific conditions that have to be met. A deduction for salaries and wages is available only if the employee is engaged in tasks connected with your business. Additionally, the payment must be for a reasonable amount.

9. Contract labor expenses

According to data gathered by the U.S. Bureau of Labor Statistics, many companies are switching over to freelancers and contractors for some tasks. There are several advantages to hiring freelancers, with the primary benefit being flexibility. You can hire workers only when there’s a need, and once a project is over you don’t need to continue paying them.

Another benefit to business owners is that the sums you pay to contractors are a tax deductible expense. Remember that if you engage contractors, you’re required to provide them with form 1099-MISC. This IRS form provides details of the payments made by your business to the contractor. Additionally, you need to give the IRS form 1096, which contains particulars on non-employee payments.

There are several advantages to hiring freelancers, with the primary benefit being flexibility. You can hire workers only when there’s a need, and once a project is over you don’t need to continue paying them.

10. Advertising and promotion

The sums that you spend on marketing your products and services, or generating leads are a legitimate business expense in the eyes of the tax authorities. Here are some expenses that apply:

- Press advertisements

- TV and radio ads

- Email marketing

- Social media marketing

- Payments for your website

4 lesser-known tips on saving taxes

The deductions listed above are essentially standard, meaning that a majority of small business owners can (and probably have) used some or all of them to reduce their income. Now let’s come to several write offs that could be overlooked due to their lesser-known nature or specific focus on niche industries:

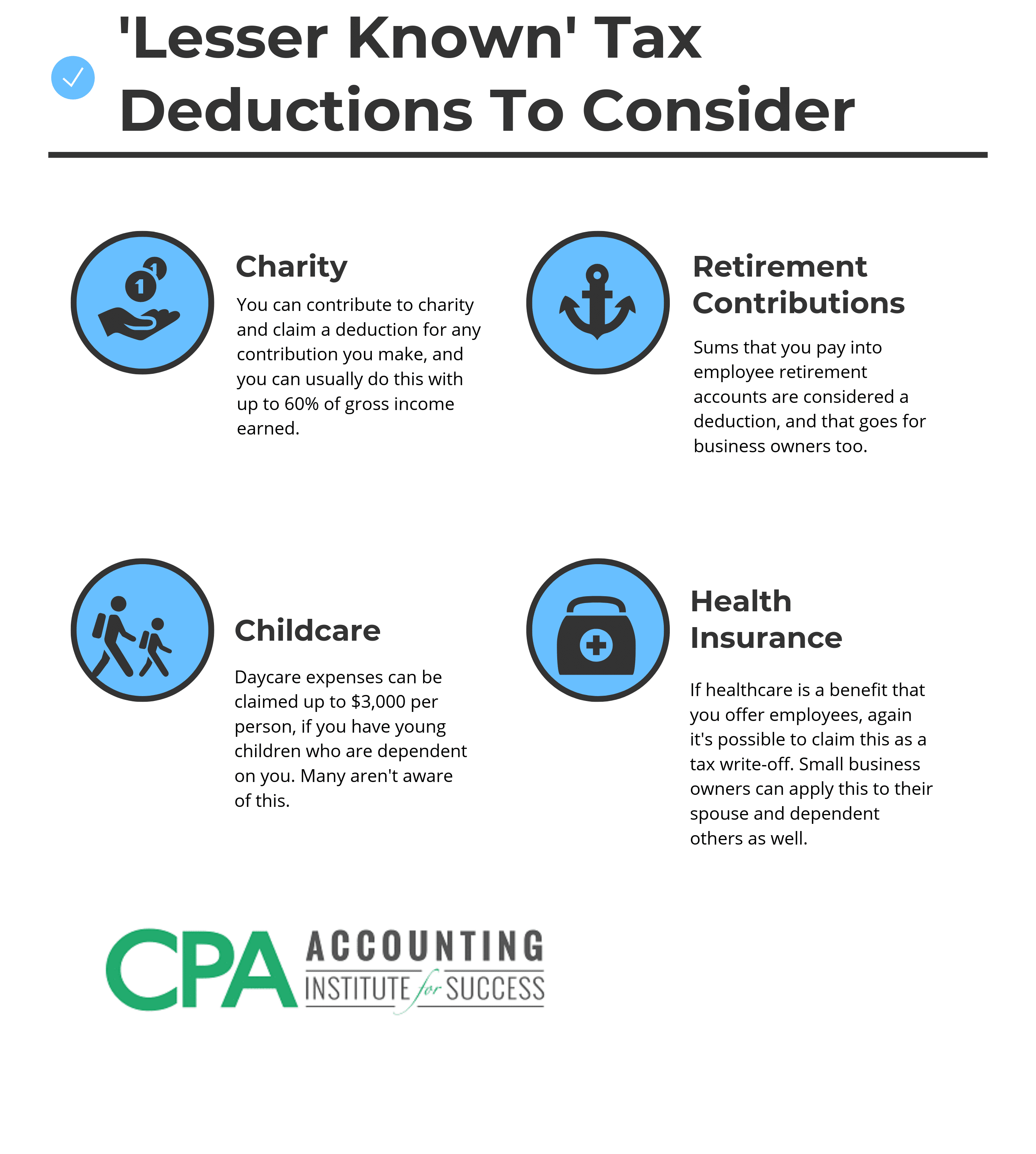

1. Charitable deductions

Entrepreneurs who plan to itemize their taxes can claim a deduction for the charitable donations they make. If you’re interested, you’ll need to attach IRS Schedule A to your Form 1040 to claim this write-off.

However, there’s a limit to the amount that you can deduct in this way— usually 60% of your adjusted gross income. However, it could be lower at 20%, 30%, or 50%. IRS Publication 526 provides more details on the subject.

2. Child and dependent care expenses

If you have young children or a disabled person who is dependent upon you, it could be necessary to spend a significant amount on daycare expenses. And while it may not seem like an applicable business expense, IRS Publication 503 describes how you can claim a tax deduction for this.

How much can you claim?

The credit you claim for child and dependent care can be as much as 35% of the expenses you incur. Additionally, this deduction decreases with the rise in your adjusted gross income. So if your adjusted gross income is between $23,000 and $25,000, you can get a write-off of 30%; but if your adjusted gross income is $43,000 or more, the credit is limited to 20%.

Finally, there’s a dollar limit to this write-off as well— It’s $3,000 for the care of one person and $6,000 for two or more individuals.

3. Retirement contributions

There are two types of contributions you can claim relating to retirement.

- As a boss, the sums that you pay into employee retirement accounts are considered to be a valid deduction.

- However, it’s also possible to claim a write-off for the amount that you pay into your own retirement account. You need to follow the rules that the IRS has laid down regarding calculating your own retirement plan contribution and deduction.

4. Health insurance tax deductions

It’s possible to claim the health insurance you pay as a tax write-off. The amounts that you pay on behalf of your employees can be claimed on the employer’s income tax return. You need to attach Form 8941- Credit for Small Employer Health Insurance Premiums.

If you’re self-employed (which is most likely the case as an owner of a small business), you can also deduct the premiums for your spouse and dependent children.

Outrageous deductions successfully made by small businesses in the past

Some business tax deductions are fairly uncomplicated. For example, it’s quite clear that you should be allowed to deduct the amount that you spend on workers’ wages. Similarly, interest paid on loans and the rent that you pay for your office are legitimate business expenses. The IRS can’t possibly dispute these.

However, other write-offs can fall into a grey area. In this section, we’ll take a look at some claims of this nature. At first glance, it would seem that they can’t be classified as business expenses. But in all these instances, it’s quite possible that the IRS could allow them.

1. MBA tax deduction

Are you a business owner who’s studying for an MBA degree? You may be able to claim the tuition fees as a business expense.

According to the IRS, work-related education expenses could be deductible from your income if you’re a self-employed individual. However, you need to meet certain conditions:

- The expense must be in connection with education that helps to maintain or improve your skills in your present work.

- The educational course that you have undertaken can’t be part of a program that will provide you with the skills you need for a new trade or business.

2. Pet food expenses and other pet tax deductions

What’s the connection between pet food and business expenses? Although slim, it seems that there is a possible link according to a past news story.

According to a report on CNBC, the IRS allowed a junkyard owner to claim the cost of cat food as a business expense? Why? The cats in the junkyard kept wild rats and snakes away— which was good for business.

3. Drunk driving expenses

You probably think that this is a cruel joke, but it’s true. In 2005, a man named Justin M. Rohrs got drunk at a party and drove his car off the road. The insurance company refused to pay because he got a DUI. Hence, Mr. Rohrs paid the car repair expenses himself and claimed the amount he spent as a business expense.

The IRS initially denied the claim, but the tax court later allowed it as a casualty loss. A casualty loss typically results from a sudden unexpected event like an earthquake or a flood— but in this case, the judge in the Tax Court ruled that it applied to Justin’s drunk driving accident. Their justification was that Mr. Rohr’s blood-alcohol level was only marginally above the legal limit, making his claim for a tax write off valid.

Important note: Don’t drink and drive! This is illegal and extremely dangerous. Also, you definitely will not receive a tax deduction for your efforts.

The IRS allowed a junkyard owner to claim the cost of cat food as a business expense? Why? The cats in the junkyard kept wild rats and snakes away— which was good for business.

The Bottom line

You can almost always reduce your expenses every tax year by maximizing your deductions. However, remember that the rules laid down by the IRS don’t provide clear instructions for every type of expense. Because of this, it’s a good idea to seek help from a tax professional when you’re filing your return. The amount you pay a bookkeeper or an accountant could be a small fraction of the taxes that you will save.

However, there’s something else that you must do as well— make sure that you keep a record of all your expenses. Maintaining copies of business-related documents is the first step that you need to take to claim all the deductions that you are entitled to.

Thanks for reading!

It’s a good idea to seek help from a tax professional when you’re filing your return. The amount you pay a bookkeeper or an accountant could be a small fraction of the taxes that you will save.

FAQ – Taxes for Small Business Owners

There are several expenses you can write off if you’re paying taxes on your small business. Some common ones include work-related travel expenses, insurance payments, and donations to charity. Your business may be qualified for additional write-offs as well; consult a tax professional to learn more about those.

Yes, you can deduct the expenses of a computer from your small business if it’s used for professional purposes. Keep in mind that a computer would need to be listed as an “office expense” and not “office supplies” in order to properly include it on your tax return.

If you’ve just started your LLC, you can deduct up to $5,000 of capital expenses in your first year of operation. After that, you can start calculating depreciation on some of these assets— however, most of your deductible expenses from this point on will be operating costs instead.

Looking specifically for freelancer tax helps? Be sure to check out our complete guide on how to do freelancer taxes here.