A Chartered Financial Analyst® (CFA®) is a specialist in the area of investment management. An individual is certified by the CFA® Institute as a CFA® charterholder only after that person has undergone a rigorous education and training process.

The specific skills that a CFA® possesses include expertise in equity and fixed-income investments, derivatives, alternative investments, and portfolio management.

Naturally, this credential is highly sought after. But why are CFA®s regarded so highly? What are the special abilities that they have?

What Are A CFA®’s Areas Of Expertise?

The CFA® credential involves an in-depth study of a wide range of subjects that are related to investments and finance. The exams conducted by the Institute focus on a “candidate body of knowledge” (CBOK).

CBOK is central to the capabilities that a CFA® has. It’s important to remember that this body of knowledge is continuously updated. Consequently, CFA® candidates remain abreast of new developments in the finance industry. Additionally, the CFA® program has a practical orientation and candidates are expected to maintain the highest ethical standard in every aspect of their work.

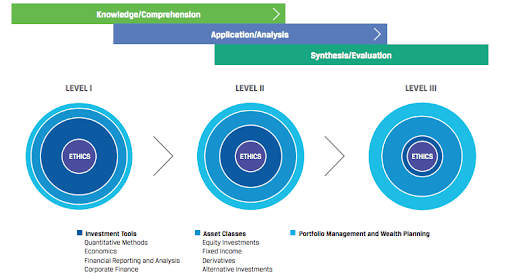

Here’s a pictorial representation of the manner. This graphic outlines how CBOK and ethical considerations impact Level I, Level II, and Level III of the CFA® program, and the subjects that candidates study:

CFA® Program Candidate Body Of Knowledge (CBOK)

Source – The CFA® Program – Where Theory Meets Practice

These are the ten areas that CFA®s study:

- Ethical and professional standards

- Quantitative methods

- Economics

- Financial reporting and analysis

- Corporate finance

- Equity investments

- Fixed income

- Derivatives

- Alternative investments

- Portfolio management and wealth planning

How Can You Become A CFA®?

There’s a long and arduous process involved in getting to call yourself a CFA® charterholder:

Eligibility to take the exam

You have to meet a specific minimum requirement before you are allowed to take the CFA® exam. There are three routes to becoming eligible:

- Option 1: You need to have completed your undergraduate degree or be in your final year. However, this rule applies only for taking Level I of the CFA® exam. You will be allowed to take Level II only after completing your bachelor’s degree.

- Option 2: You need to have completed four years of professional work experience. However, this need not be in the field of investment or finance.

- Option 3: this is a combination of options 1 and 2. You can enroll in the CFA® course if you have a total of four years of professional work experience and education.

Remember that the reference to work experience in options 2 and 3 refers to a full-time position and not to part-time work.

Passing the three levels of the CFA® exam

The Level I exam is held in two three-hour sessions on a single day. Hence, you are required to answer 120 multiple-choice questions in the morning session and another 120 multiple-choice questions in the afternoon.

Similarly, Levels II and III are held in two sessions on the same day. Level II requires you to answer a total of 120 items divided into 20 “mini-cases.” You are required to read a case scenario and then answer the six questions that follow. Again, as in Level 1, all the 120 problems are of the multiple-choice variety.

The format of the Level III exam is different. As in Level II, there are case scenarios followed by multiple-choice questions. But there are essay questions as well that require you to write your response.

Keep this in mind: these tests are not easy. Their pass rates are low and you will need to study hard in order to pass. We recommend obtaining a study guide or enrolling in a prep course.

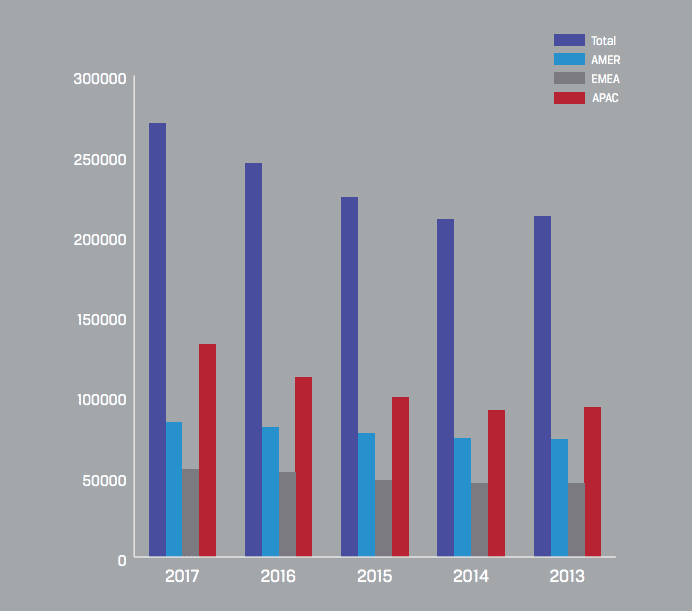

Every year, the number of individuals taking the CFA® exam increases. This chart from the CFA® Institute’s Annual Report for the fiscal year 2017 illustrates this point:

CFA® Program Administrations by Region

Source – CFA® Institute’s Annual Report for the fiscal year 2017

Five countries (the U.S.A, the U.K, China, Canada, and India) account for two-thirds of the total number of CFA® candidates. In FY 2017, there were more candidates from China than there were from the U.S.

Work experience

The eligibility criteria for gaining membership to the CFA® Institute doesn’t stop with passing all three levels of the CFA® exam. You need a specific type of work experience as well.

You are required to have worked a minimum of 4 years in a full-time job that involved analyzing or evaluating financial or economic data. Fortunately, you are allowed to accumulate this work experience before, during, or after you pass the exam.

Become a member of a local chapter

There is one final requirement that you must meet before you earn the designation of “CFA® charterholder.” You have to join the CFA® Institute as a regular member. There are dozens of CFA® societies spread across the world.

How Much Does It Cost?

You will have to pay an initial program enrollment fee of $450. Subsequently, you will need to pay for each of the CFA® exams (Level 1, 2, 3). But the good news is that you can save by registering early.

For example, the exam fee that you could have paid for June 2019, for Levels I, II, and III was $650 if you had registered by 17 October 2018. Register by 13 February 2019, and you need to pay $950. The most expensive option is to register after 13 February 2019; this will involve a payment of $1,380. The payment window ends on 13 March 2019. Consequently, if you don’t pay by this date you will have to wait for the next exam date.

Remember that Levels I, II, and III are held in June every year. In December, only Level I is offered.

Job Prospects For CFA®s

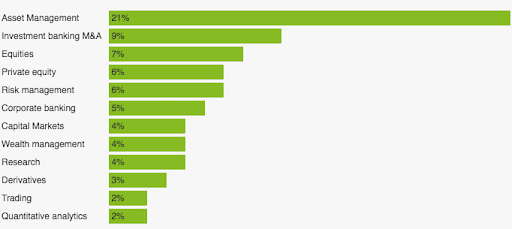

Where do individuals who hold the CFA® qualification work? This graphic from job site eFinancialCareers provides an answer:

Sectors with the highest proportion of CFA®-qualified employees

Source – eFinancialCareers

eFinancialCareers analyzed the data from about 32,000 resumes that individuals submitted to them. It found that CFA® charterholders and students work in the following companies:

| Company | What the company does | % of employees who have completed at least one level of the CFA® course | % of employees who are CFA® charterholders |

| Pimco | Investment management | 30% | 4.2% |

| Blackrock | Investment management | 26% | 5.6% |

| KKR | Investment management | 23% | 3.4% |

| Carlyle Group | Investment management | 22% | 1.5% |

| Vanguard | Investment management | 20% | 2.3% |

| Blackstone | Private equity | 20% | 3.6% |

| Apollo Global Management | Alternative investments | 20% | 4% |

| Goldman Sachs | Investment bank | 19% | 3.5% |

| UBS | Investment bank | 18% | 2.6% |

| Lazard | Investment management | 18% | 3.2% |

According to a recent report, a CFA® earns between $53,000 to $118,000 with the salary rising as the number of years of experience increases. Those with ten to 19 years of experience earn approximately $127,000 while individuals with 20 or more years in financial services could make $156,000 per year.

Of course, the salary could vary widely between organizations. The employee’s responsibilities and the nature of work would also play a significant role in determining the pay package.

Deciding between a CFA® and an MBA

The difference between a CFA® and an MBA is best summed up in an article in Forbes, which says that “… the MBA program is a mile wide and a foot deep, while the CFA® program is foot wide and a mile deep.”

The CFA® program focuses on a specialized area. Candidates gain expertise in investment management, portfolio management, and asset allocation. An MBA, on the other hand, studies a wide range of subjects that include financial management, marketing, human resources, and business operations.

So, which course should you choose? The answer depends on the area that you plan to work in. If you want to apply for a job in an investment management firm, the CFA® course could be a better choice. However, if your career objective is to work in marketing or HR, an MBA may be more appropriate.

The Bottom Line

Completing the CFA® program will give you a well-recognized and highly respected credential. If you become a CFA® charterholder, it’s likely that you will be able to get a job with a good pay rate. In many investment management companies and private equity firms, CFA®s have a greater chance of being promoted than their peers.

However, it is crucial to remember that the CFA® course is difficult. You need to put in long hours of work to prepare for each of the three levels. Furthermore, you should also be good with numbers and have the ability to retain a large amount of information and apply it during the exam.

If you meet all these requirements, go ahead and start the course. Gaining the CFA® credential will boost your career and improve your employment prospects.

CFA® Institute does not endorse, promote or warrant the accuracy or quality of AIS-CPA.com. CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA® Institute.